BTPN Jenius Review

Due to its bureaucratic inertia, the banking business has to be one of the slowest sectors to adapt to new technologies. While new flashy gizmos do exist, especially payment technologies (e.g. Apple Pay, Android Pay, Visa PayWave, cryptocurrencies, and in Indonesia there are TCash, e-money cards, and countless other small startup stuffs), the consumer banking experience stays roughly the same: to be able to use the bank’s services, you often still have to go to a physical building and hassle with the paperwork and the queue. While majority of the banks have some kind of online services, they mostly function like a cashless ATM that can only do a simple send and receive transaction. Not exactly a thing that you would call ‘innovative’.

Jenius (a subsidiary of Bank Tabungan Pensiunan Negara) is a relatively new Indonesian banking solution that tries to solve this problem. The one-liner that perfectly captures how Jenius works is this: rather than extending the existing ecosystem to the online realm, they ground their services onto your smartphone. Now, what does that mean? I think the best way to explain is to actually tell you the whole experience.

Getting Rid of the Bulk

Firstly, this is where I’ll tell you how Jenius managed to trim some of the corporate banking shenanigans that exist in the conventional bank. Please note that this article is written in early 2018, so there might be some differences.

To create a Jenius account, rather than going to the BTPN office, you instead fill the registration form yourself through the Jenius app downloaded from the app store. This includes uploading pictures of your signature, ID card (KTP), and NPWP. Once your account is created, you need to verify it. This is done in two ways: by having a staff come to your location to verify your ID card and NPWP (by the time of writing, available in Jabodetabek only) or come to the nearest supported BTPN office. Yes, you may still need to go to a physical place but this is probably the last time you need to visit one. After the registration, you won’t get any formal documents that entitle you to their services, it’s all in your online account.

Unlike regular bank account, with Jenius you will simultaneously get a checking account, a saving account, and a timed deposit account (deposito). You don’t have to register them separately or get a certificate of deposit, it’s all managed through the mobile app or the web. You can distribute your money accordingly and set your own principal and maturity term for your timed deposit from there.

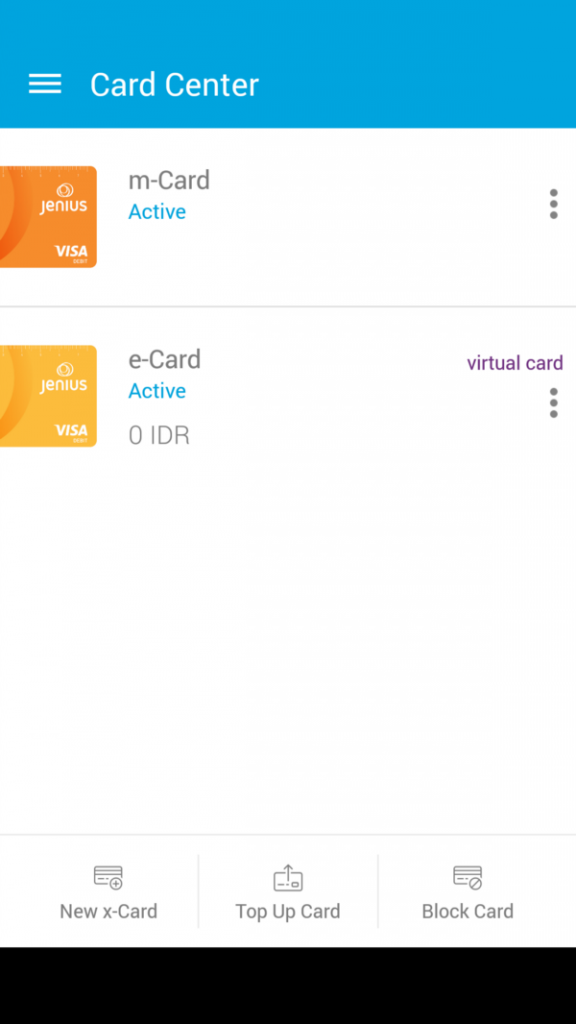

You’ll also get a debit card (marketed as ‘m-card’) that is integrated to the app. By ‘integrated’ I mean that you can manage your PIN, your spending and withdrawing limit, and the status of your card (blocked or unblocked) right from the app, instead of having a teller to do it for you. You’ll also get a virtual prepaid card (marketed as ‘e-card’) and optional physical prepaid card (marketed as ‘x-card’, you can get up to 3 of these) and all of them can be topped-up and managed the same way as the debit card from the app.

Because you essentially have an online account, you can also change your personal information right from the app. This include your name, date of birth (not sure why would you want to change those), username, cashtag (more on this later), password, and your correspondence address. However, you can’t change your ID card information or NPWP, for regulatory reasons.

Although not completely bureaucrat-free, all of those pruning has led Jenius to be a virtually fee-less service. No opening fee, no closing fee, no monthly administration fee, no minimum balance, and no card fee. BTPN will only start to bill you if there is an external network thrown into the mix (e.g. transferring and requesting a balance inquiry on inter-bank network) although each month you will get 25 fee-less inter-bank transfer and 25 fee-less money withdrawal if you use Prima or Bersama network. Neat!

The Social Twist

Jenius also tries to make exchanging money between its users easier and I would argue that PayPal is probably the major inspiration taken by the design team of Jenius.

Let’s start with the ‘cashtag’ thingy I mentioned earlier. Your Jenius profile is identified with a cashtag. In a nutshell, cashtag is like a Twitter username but instead of using @, you use $ (e.g. $john_doe). With this cashtag, you can send, pay, and request payment to and from a person without referring them with an account number.

Okay, that is not strictly a PayPal feature 🙂 but let me elaborate. They both central on an online platform that is socially connected via an easily-recognized identity. Both can send and request (that’s 2-way interaction) money from other arbitrary users or known saved contacts. Where they differ though is in their philosophy. Jenius kinda see themselves primarily as a platform for people to exchange money, as opposed to PayPal which is primarily a platform of online payment for a corporate entity — just look at the name!

Philosophy aside, Jenius has a few social features in addition of what PayPal is already doing. Firstly, you can form a group. You can send money to a group and specify the exact amount of money that you want to send to each of its member. This is a useful feature if you regularly send money to a set of people; family members for example. You can also request money from a group: a split-bill. Same as before, you specify the exact amount that you want to ask from each person and send them the request. A useful feature for the type of person who likes to have a fancy dinner together with their friends.

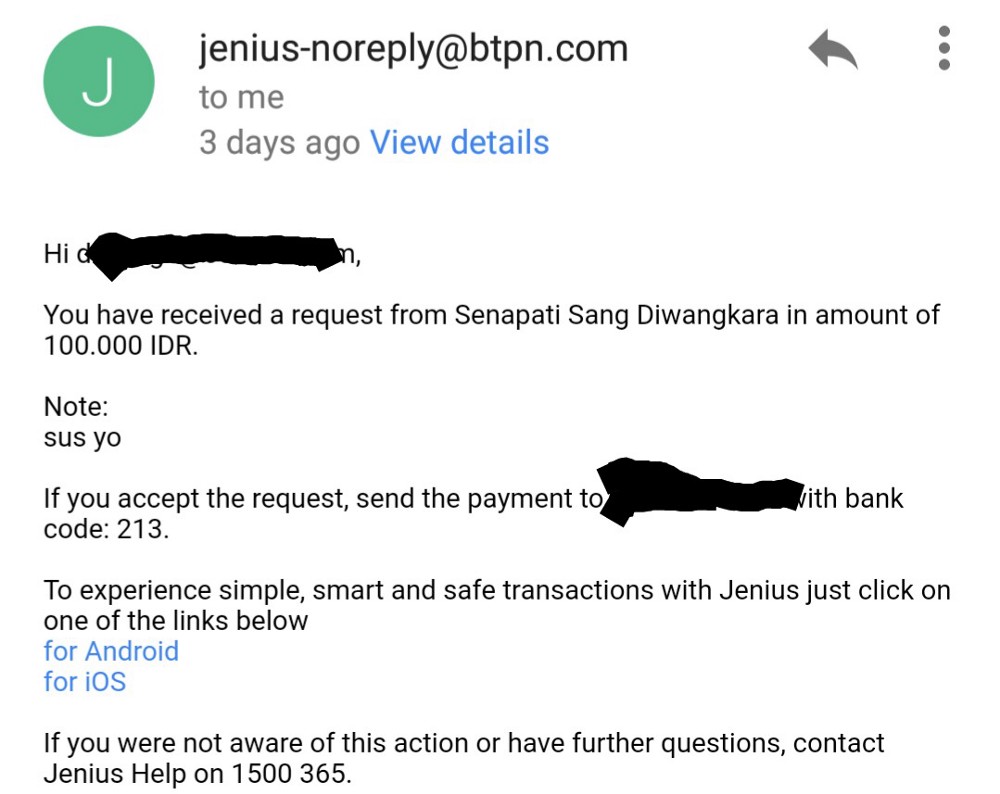

“What if my friends don’t use Jenius?” you might ask. Well, you still kinda have the ability to use those features just with the conventional protocol. For example, if you want to request money from a non-Jenius user, you instead send them an email or SMS containing your bank number and the amount that you should transfer. Not a very seamless experience but hey, what do you expect?

Minor Cons

This leads us to the few disadvantages that Jenius has, that is mainly due to its novelty.

By the time of writing, Jenius had only started to pick up public’s attention and there are still very few Jenius users in the wild. Majority of the time, using Jenius social services feels no different than using a regular online banking services: sending money by account number and requesting money is just the same as privately messaging your friend about it in the first place.

Paying for bills is also one of its downside because the billing option is not as robust and complete as the billing option offered by the major banks. Jenius only supports transaction from a few large corporations, e.g. credit card payment, prepaid mobile phone credits, postpaid phone bills, and Kereta Api Indonesia online ticketing. It doesn’t yet support the kind of multipayment protocol developed by the major Indonesian banks like Mandiri or BCA to support smaller businesses.

But fortunately, all of those problems are not a fundamental problem and can be fixed in the future. If Jenius succeeded in getting more mass adoption, I think those problem would be greatly diminished.

So there, that is what I mean when I said “They ground their services onto your smartphone”. Although not completely free from unnecessary bureaucratic antiquities, they managed to properly build a banking system for the smartphone era, rather than a simple remasking of the old one; a truly disruptive technology in the banking system.

Now, let’s see how those innovation stands against the upcoming competitors that will soon come.